A RISK MANAGEMENT LEGACY SYSTEM REDESIGN

Transforming a tangled legacy system into an intuitive platform taught us that sometimes the hardest part of UX design isn’t the design—it’s earning the trust to change what’s been broken for years.

COMPANY

Cambridge (Corpay)

ROLE

UX Research / UX Design / UI Design / Product Strategy

PRODUCT

Risk Management Platform

SITUATION

OVERVIEW

During my time at Cambridge (now Corpay), I led a pivotal initiative to rebuild their internal Risk Management platform, supporting hedging strategies like closed rollovers, forward contracts, and options contracts. In financial terms, hedging mitigates risks associated with adverse price movements. A critical example is the Closed Rollover strategy, which allows companies to extend a financial contract’s expiration, maintaining their currency risk protection beyond the original contract’s maturity.

This case study is about more than redesigning a legacy system within a corporate hierarchy. It highlights how I engaged all stakeholders in the design process and developed a pilot product, rigorously tested to establish trust and buy-in for UX across the company. By involving users, stakeholders, and decision-makers early and throughout, we created pilot product that proved the strategic value of UX. This collaborative approach ultimately laid the foundation for a company-wide shift towards embracing design thinking and UX design for the following initiatives for redesigning the risk management platform.

NOTE

Details on the initial version of the website may be vague to protect the client’s intellectual property.

OPPORTUNITY

The 20-year-old platform at Cambridge had become a bottleneck for traders, demanding up to 6 to 10 minutes per closed rollover—one of 10 to 30 daily tasks—assuming it didn’t crash and that the trader is working quickly. Its inefficiency and frequent errors not only wasted valuable time but also caused frustration and eroded client satisfaction. This project offered an opportunity to modernize the system by addressing error-prone processes, automating redundant tasks, and streamlining workflows.

A screenshot of a trader completing a closed rollover with the multiple viewports opened and stacked.

An example of a struggle for traders was the need to navigate multiple viewports for different steps of the process, with no clear linear workflow to follow. To complete a task, traders had to keep all viewports open simultaneously, constantly switching between them to reference numbers and manually copy and paste information. This not only slowed them down but also increased the risk of errors and made an already complex task even more cumbersome.

PROBLEM STATEMENT

WHO Traders and treasury department users at Cambridge who rely on the Closed Rollover hedging platform to process client risk management initiatives.

WHAT A large volume of user complaints about the platform being unreliable, slow, and inefficient, significantly increasing the time required to complete tasks.

WHERE Within the internal Closed Rollover hedging platform used for managing client hedging processes.

WHEN During the execution of client-facing tasks, such as processing closed rollovers and other risk management initiatives.

WHY The legacy platform, developed over 20 years ago with limited resources and a small team, was built without the benefit of research-driven planning or user-centered design. This resulted in a system that prioritizes backend functionality over user workflow efficiency, leaving traders to navigate an outdated and cumbersome interface.

The Closed Rollover hedging platform at Cambridge, built over 20 years ago with limited resources and no user-centered design, has become unreliable, slow, and inefficient. Traders and treasury users struggle to complete risk management tasks due to a disjointed workflow and outdated interface, leading to frequent complaints and operational delays.

The Closed Rollover hedging platform at Cambridge, built over 20 years ago with limited resources and no user-centered design, has become unreliable, slow, and inefficient. Traders and treasury users struggle to complete risk management tasks due to a disjointed workflow and outdated interface, leading to frequent complaints and operational delays.

ACTION

RESEARCH GOALS

Our study aimed to evaluate the efficiency and usability of the legacy system to uncover traders' daily workflows, interactions, behaviors, key pain points, and desired improvements, as well as understand the system's affordances for risk management initiatives. We achieved this through qualitative methods such as observational studies and contextual inquiries.

Equally crucial were quantitative insights, which provided a holistic understanding of traders' experiences. We did so by assessing metrics like learnability, efficiency, and error frequency.

RESEARCH METHODOLOGY

To better understand our traders’ experience with the legacy system, we applied a mixed-methods approach combining qualitative and quantitative research.

Traders’ userflow using the legacy platform to process a closed rollover based on contextual inquiry.

METHODS

User Interviews

One of the unexpected challenges during our research was conducting internal user interviews with traders. Many were hesitant to provide detailed or honest feedback about the legacy system, fearing it might be perceived as criticism of the company or reported negatively. This challenge underscored the importance of building trust and rapport with our interviewees, a dynamic that was notably different from working with external users. The challenge here really highlighted the importance of building a relationship with our interviewees and how vastly different it was from interviewing external customers/users.

Usability Testing

Our moderated and unmoderated usability testing uncovered behaviors and interactions that interviews alone could not reveal. For many traders, this was their first exposure to usability testing, requiring us to educate them on iterative design processes and the role of testing within them. A significant effort went into gaining buy-in from their managers, helping them understand the value of 1:1 sessions in reducing biases and surfacing actionable insights.

Contextual Inquiry

A common challenge during contextual inquiry was participants becoming overly focused on proposing solutions rather than demonstrating their workflows. While their enthusiasm was valuable, it often shifted the session away from observing real behaviors, leading to unrealistic expectations about immediate outcomes. This highlighted the importance of managing expectations early by clearly outlining the study’s purpose and scope. By addressing this upfront, we ensured sessions stayed focused on understanding workflows while maintaining constructive collaboration.

HYPOTHESIS

Automating repetitive tasks will reduce task completion time for processing client orders.

Implementing a user interface with a focus on visual hierarchy will minimize cognitive load and improve task efficiency during trader workflows.

Replacing manual processes with automated calculations will decrease error rates and improve consistency in order processing.

RESULTS

Brainstorming corresponding functions between old and new design

FINDINGS

Our research led us to confidently rule out a piecemeal approach to implementing improvements. Discussions with the development team revealed that the legacy system's restrictive tech stack could not support the significant overhauls we proposed. This led to the decision to redesign the entire system and roll out the MVP as a new product, rather than attempting to fix features within the existing platform.

While this approach allowed for much greater flexibility in improving other processes on the risk management platform, it also came with higher stakes. Designing and developing a new product required addressing a broader scope of features, and it posed adoption challenges for traders accustomed to the legacy system. Although not my go-to approach, this decision was necessary to ensure a stronger foundation for future scalable improvements.

In certain scenarios, system overhauls are more effective than relying on incremental fixes.

A snippet of a trader’s session with

on the legacy platform.

Observing traders process closed rollovers on the legacy platform revealed significant inefficiencies. Much of their time was spent locating the correct text fields, dropdowns, or buttons hidden among loosely arranged UI elements across multiple windows. Despite the closed rollover being conceptually straightforward, limitations of the outdated tech stack resulted in a fragmented and cumbersome experience. Many actions in the flow were unnecessarily repetitive, such as requiring four windows to swap two legs of a trade, when much of the data could have been fetched and automated.

BUILDING RELATIONSHIPS

When we proposed a new design, traders split into two groups. Newer traders welcomed the change, while some other traders were resistant, relying on their established workflows.

To gain buy-in from the latter group, we demonstrated the benefits of the redesign and involved them in planning to show how it would save time. Building trust was crucial; we reassured them of the new system’s ease of use and committed to providing support and training, which helped earn their confidence.

The commonly overlooked importance of relationship building in user interviews.

WHAT TRADERS WERE SAYING

“It’s a problem when I’m questioning the accuracy of the calculations.”

“Some buttons don’t do what they’re supposed to and I have to follow a routine of steps to make them work.”

“I spend more time trying to understand all my open windows and organizing them than actually sending the order through.”

“Processing one order means entering the same data into four different windows. This is extremely tedious.”

CHALLENGES

Replicating the old platform in the new system presented significant challenges, primarily due to the extensive backend reverse engineering required before the development team could start on the new development. Furthermore, since the new platform was built using a different language and most of the backend logic were tied to many streams of live data sources, the development team had to rework foundational formulas and analyze how they could develop something that could connect to those old live data sources.

CROSS-FUNCTIONAL DEPENDENCY & COLLABORATION

Given the urgency of the project, the redesign required close collaboration between cross-functional teams. This also in turn made the transition into the new platform easier for the traders since the design was not a surprise to them.

Close collaboration with traders in mapping out functions

CREATING SAFE SPACES FOR FEEDBACK

Another challenge we encountered, while not unique to this project, was obtaining honest feedback and qualitative data from traders. Building trust was crucial, as many traders were initially hesitant to share their true opinions out of fear that their comments might be reported or misinterpreted. To address this, we focused on relationship-building by evangelizing UX design principles and emphasizing the importance of their candid input in improving the system.

Additionally, we needed to be transparent about our process, particularly the value of 1:1 conversations, and justify the time traders were pulled away from their regular responsibilities. This highlighted a key realization: conducting research with internal staff is often more challenging than with external customers, as internal users may feel additional pressure or constraints when providing feedback.

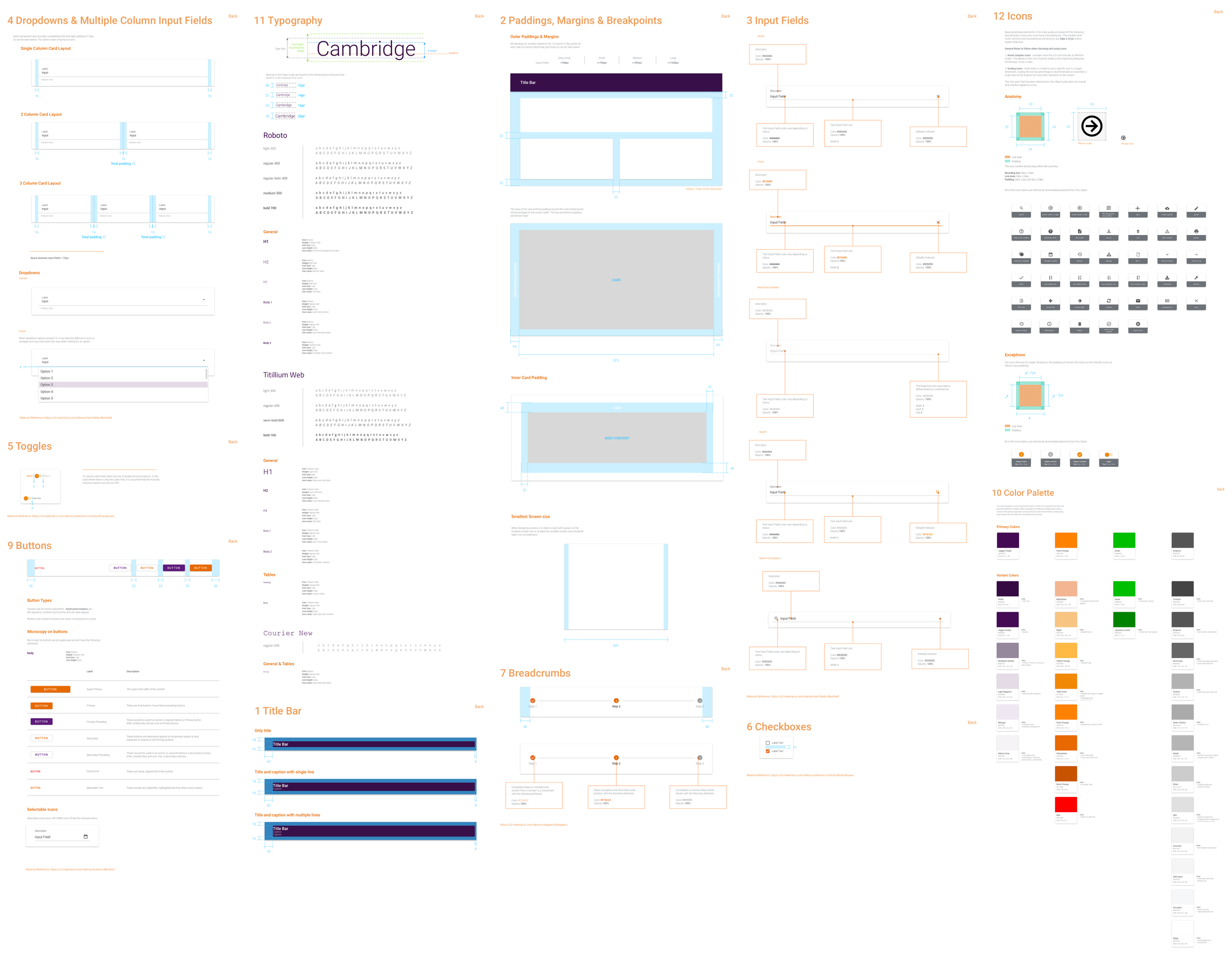

DESIGN SYSTEM

For companies with low UX maturity, introducing the idea of creating and implementing a design system can be challenging due to the significant time and cost involved. As a two-person UX design team, this required a substantial investment of resources and careful justification to gain buy-in from leadership.

To address this, I collaborated closely with members of the development team to understand how best to communicate and visually present these concepts in a way that made sense to the development team. In doing so, I also evangelized UX principles, offering insight into the priorities and value of UX and UI design. These early conversations not only fostered stronger relationships between teams but also laid the groundwork for easier buy-in across departments when pitching the design system later.

An effective design system goes beyond easy adoption by all teams; it must deliver a meaningful positive impact on operations, consistency, workflows, or other targeted aspects. Without a clear and measurable impact, the design system likely suffers from a lack of clarity in its goals or intentionality in its implementation.

Design system collaboration with development team

live estimations component

SOLUTIONS

Gaining advocacy for a redesigned platform can be challenging, especially with users who are resistant to change and accustomed to their existing workflows. For these traders, I dedicated additional time and resources to preparing training sessions and support documents to ease the transition. Ultimately, their main concern was seeing a justification tied to their specific workflows, ensuring the redesign wouldn’t impose a steep learning curve.

FRONTEND PRIORITIZATION

One of the most impactful efficiency improvements in the new design was automating the “Housekeeping” stage that previously required traders to input the same data across four separate windows for each currency pair. The redesigned process simplifies this by requiring users to enter only the two primary currencies and their amounts, with the backend handling the rest. Recognizing that traders didn’t need to see the intermediate steps, we streamlined the workflow to skip unnecessary stages, allowing them to focus directly on inputting custom rates after reviewing currency estimations.

LIVE RATE ESTIMATIONS

A feature that generated significant enthusiasm among traders was the introduction of live currency estimations. Previously, traders relied on static currency quotes, which often became outdated by the time they completed other parts of the order. This outdated information caused frustration, particularly given the time-sensitive nature of their workflows and the need for accurate estimations.

Iterations on a user flow that includes live currency estimations

live estimations component

ELIMINATING REDUNDANT OPERATIONS

The new design consolidated the entire rollover process into a single window, allowing traders to complete tasks without switching between screens. While the legacy platform appeared complex, further analysis revealed a lack of initial effort in mapping backend processes effectively. The frontend design also exposed unnecessary backend operations, placing a heavy manual burden on traders. Instead of streamlining workflows, the system required users to compensate for its inefficiencies—an approach that contradicted the core purpose of an effective platform, which should simplify and automate processes.

Legacy system with multiple viewports for different steps in closed rollover

New design with all processes in closed rollover housed in one viewport

The new three step closed rollover design

Traders described the legacy system as overwhelming and emphasized how much more manageable the new design felt. One trader even noted, “It’s no longer an eyesore to work with.”

POST-LAUNCH EVALUATIONS

45%

decrease in error rates

COMMUNICATE IMPACT

One of the key lessons learned was the importance of effectively communicating the impact of our efforts to traders for adoption and transparency.

66%

reduction in task completion time

DRIVE CONTINUOUS IMPROVEMENT

Validating that automating repetitive steps reduced task completion time by 66%.

RETROSPECTION

STAKEHOLDER INERTIA

The transition from the legacy system to the new platform underscored the challenges of overcoming stakeholder/user inertia. Traders’ deep attachment to their established workflows led to initial reluctance to adopt the new system. While workshops and collaborative efforts helped build trust and foster a sense of ownership, we realized that earlier and more frequent engagement with these users might have further eased the transition. This experience highlighted the critical importance of involving stakeholders throughout the process to mitigate resistance and create smoother adoption pathways.

LEVERAGING POSITIVE METRICS

The positive metrics from post-launch evaluations—such as reductions in error rates and task completion time—provided valuable benchmarks for future projects. While these metrics were effectively used to communicate the redesign’s success and advocate for further UX investment, there is room for improvement in how we link these outcomes to long-term organizational goals. Better alignment of metrics with strategic objectives would have amplified their impact and further supported efforts to expand UX practices to other risk management processes.